How Pierre Poilievre’s Capital Gains Tax Proposal Could Change Real Estate Investing in Ontario

Are You Ready for a Potential Shakeup in Ontario Real Estate Investing?

Changes to the capital gains tax system could be on the horizon—if you’re a real estate investor in Ontario, now is the time to prepare. The proposed plan by federal Conservative leader Pierre Poilievre aims to eliminate capital gains tax on real estate in Ontario—but only if you reinvest those gains in Canadian assets.

Let’s unpack what this could mean for landlords and investors in the province.

Understanding Capital Gains Tax for Ontario Real Estate

Right now, selling an investment property in Ontario means facing a tax hit:

- 50% of your capital gains are taxable

- That amount is added to your personal income

- Rental properties are not eligible for the Principal Residence Exemption

Example: If you sell a rental and make a $200,000 profit, $100,000 is taxed—often at Ontario’s highest marginal tax rate (53.53%).

This system discourages investors from upgrading or reallocating their rental portfolios.

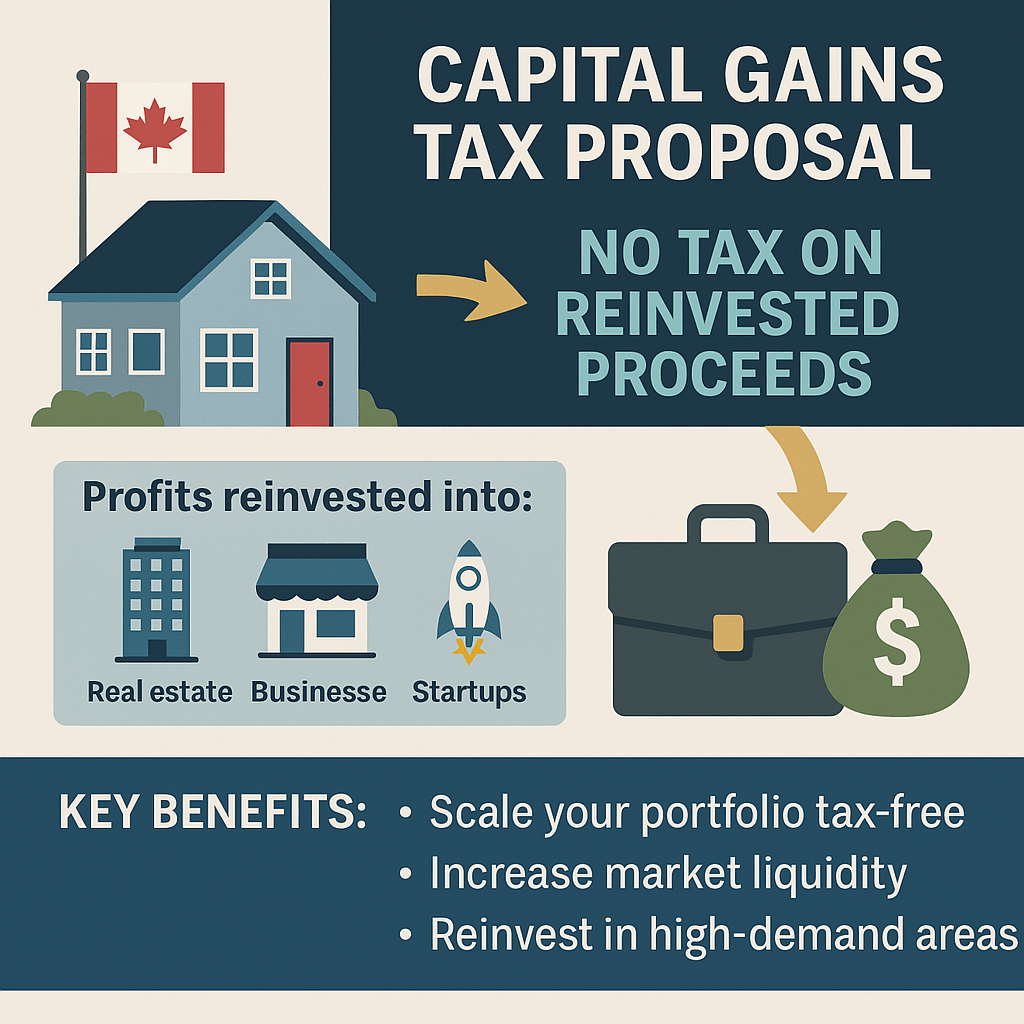

What Poilievre Is Proposing

Pierre Poilievre’s plan could eliminate capital gains tax on profits reinvested in Canadian assets, such as:

- Real estate

- Canadian businesses

- Startups

If implemented, this capital gains reinvestment policy would allow investors to sell and reallocate capital without triggering a tax bill.

Typical policies like this include:

- Reinvestment windows (6–12 months)

- Holding periods (keep the new asset for 2+ years)

- Only Canadian-based assets qualify

💡 Learn more about current taxation at Canada Revenue Agency – Capital Gains

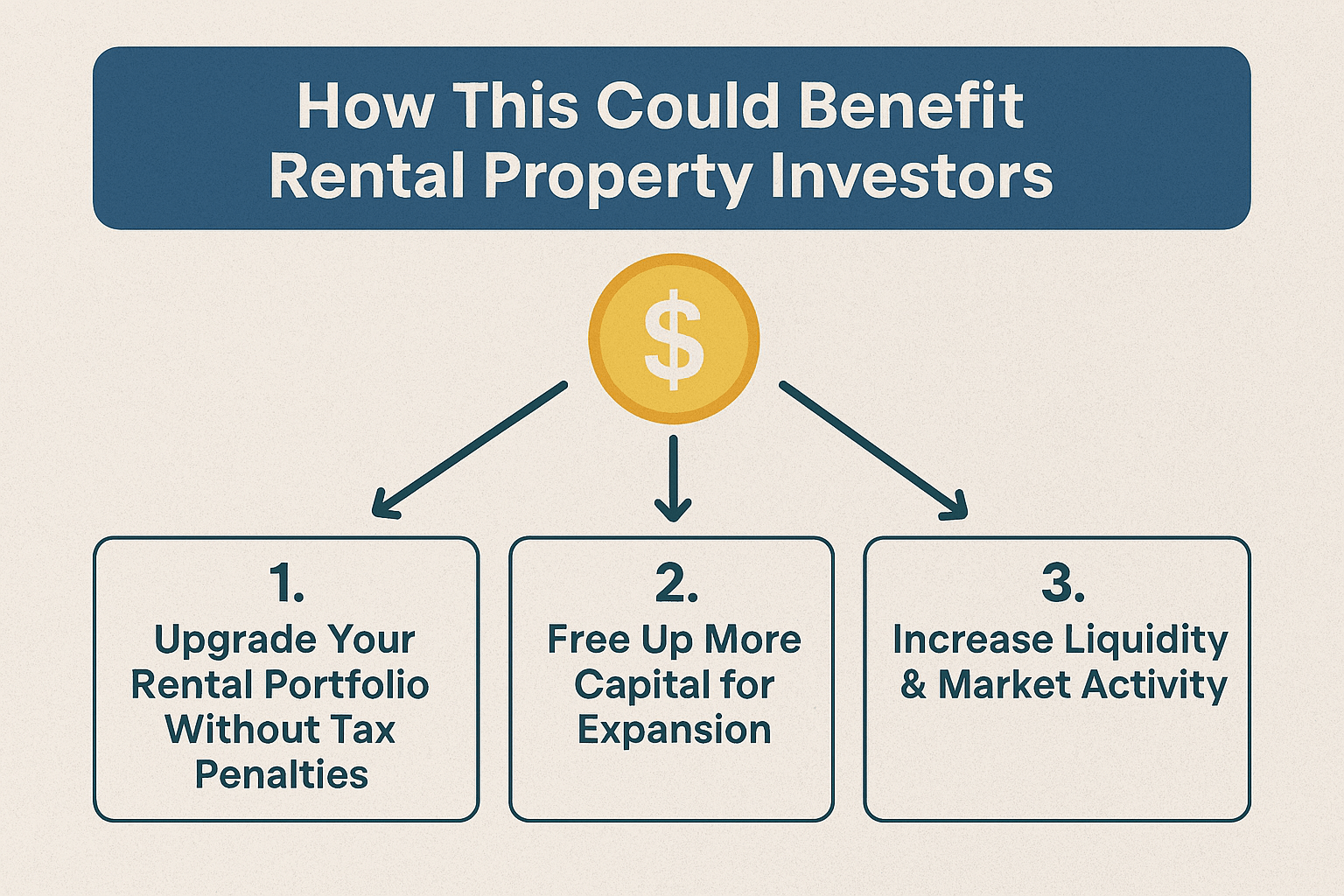

How This Could Benefit Rental Property Investors in Ontario

1. Upgrade Your Portfolio Tax-Free

Sell older properties and reinvest in higher-performing rentals in places like:

- Belleville

- Trenton

- Kingston

2. Unlock Capital for Expansion

With no tax bite, you could afford to:

- Renovate existing rentals

- Acquire multiple properties

- Enter growing regional markets

3. Increase Ontario’s Rental Market Liquidity

Investors often avoid selling to dodge taxes. If that roadblock is removed, we’ll likely see more properties change hands—benefiting tenants and investors alike.

Real-World Example: The Tax Savings

Scenario:

You sell a rental for $500,000 with a $300,000 capital gain.

- Current system: You pay ~26.76% tax on $150,000 = $40,140 in tax

- Proposed system: Reinvest into another property → $0 capital gains tax

That’s over $40K saved—and more capital for your next investment.

Risks & Unknowns for Investors

1. The Policy Is Still a Proposal

As of now, it’s not law. Plan, but don’t act prematurely.

2. Market Prices Could Climb

With more investors rushing in, prices—especially in suburban markets—could spike.

3. Deferral ≠ Exemption

Some policies only delay capital gains tax until the new investment is sold. Understand how it’s structured before jumping in.

What Ontario Investors Should Do Now

✅ 1. Run the Numbers with a Rent vs. Sell Calculator

Use our Rent vs. Sell Calculator to weigh your options and see how reinvestment might affect your bottom line.

✅ 2. Research High-Growth Markets

Focus on areas with strong rental demand and tenant stability:

- Belleville Property Management

- Trenton | Quinte West Rentals

- Kingston & Durham suburbs for long-term renters

✅ 3. Work With Real Estate & Tax Experts

Even if Poilievre’s policy passes, compliance will be key. Consult advisors to stay ahead of changes.

💼 Read: Ontario Landlord-Tenant Law Changes 2025 for additional compliance tips.

Final Thoughts for Ontario Landlords

Whether you agree with Poilievre’s politics or not, his capital gains tax real estate Ontario proposal could reshape investment decisions for years to come.

Key Takeaways

- This policy could eliminate capital gains tax if you reinvest in Canadian assets

- Ontario investors may be able to upgrade portfolios without a tax hit

- There are still uncertainties, so plan cautiously

- Now is the time to review your strategy and explore growth markets

Need Help Planning Your Next Move?

At Blue Anchor Property Management, we help Ontario landlords:

- Understand tax changes

- Grow rental portfolios strategically

- Avoid costly legal mistakes

📞 Book a consultation to learn how we can support your investment goals in 2025 and beyond.