NR4 Slip Ontario: Easy Guide for Foreign Property Owners

In This Article:

What Is an NR4 Slip Ontario?

An NR4 slip Ontario is a tax document issued by the Canada Revenue Agency (CRA) that shows how much tax was withheld from your Canadian rental income. If you’re a non-resident who owns property in Ontario and earns rental income, this form proves you’ve paid the required tax.

Non-residents include anyone living outside of Canada, such as in the U.S., U.K., Australia, or Europe. Even if you never visit Canada, the CRA still wants tax on money earned from Canadian real estate.

🔎 For related info, see our guide: The Power of Property Management in Ontario.

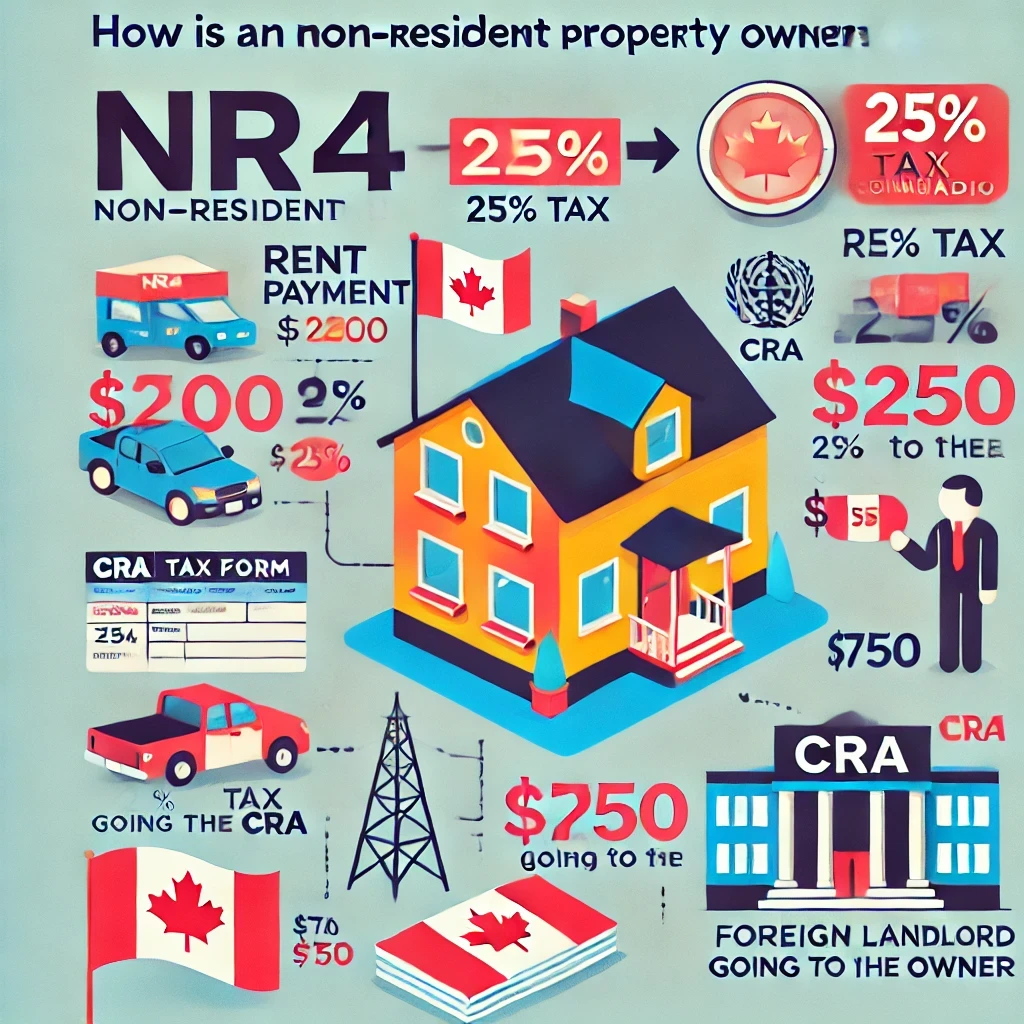

Why Canada Withholds 25% of Rent

Under Canadian tax law, 25% of gross rental income must be withheld and paid to the CRA by non-residents. This is called a withholding tax.

For example, if your property earns $2,000 in rent each month, $500 must be sent to the CRA. You keep the remaining $1,500. At the end of the year, you’ll receive an NR4 slip showing the total amount withheld and remitted.

This system ensures that taxes are paid upfront and on time.

💡 See also: Understanding Property Management Fees in Ontario.

How Property Managers Help

If managing taxes from abroad sounds stressful, don’t worry. A professional property manager like Blue Anchor can handle it all for you.

- We collect rent from your tenants

- Withhold and remit 25% to the CRA

- Track all payments and paperwork

- Send your NR4 slip at year-end

This ensures you stay compliant without lifting a finger.

🎯 Want fewer tenant issues? Read: Tenant Disputes in Ontario: How to Avoid Them.

What to Do With Your NR4 Slip

Once you receive your NR4 slip, keep it safe. It’s essential for your Canadian tax filings. Here’s what to do:

- Store a digital and printed copy

- Use it when filing a Canadian tax return

- Provide it to your accountant

- Reference it for refund claims

Can You Get a Tax Refund?

Yes. If your rental expenses are high or your income is low, you may be entitled to a tax refund. Common deductions include:

- Property management fees

- Mortgage interest (if applicable)

- Insurance, repairs, and utilities

To claim a refund, you’ll need your NR4 slip and possibly file a special return (see next section).

💸 Read our full breakdown on Rental ROI & Real Estate Deal Analysis.

Why the NR4 Slip Is Important

This document is vital because it:

- Proves your taxes were paid correctly

- Helps you apply for refunds

- Keeps you compliant with Canadian law

- Simplifies tax preparation

Failing to manage this properly can result in penalties, interest, or loss of tax refund opportunities.

Filing a Section 216 Return

Non-residents can file a Section 216 return to report rental income and expenses. This allows you to pay tax on your net income—not gross rent.

Many foreign investors do this to reduce their tax burden and receive refunds. Talk to a Canadian tax advisor to see if it’s right for you.

Get Help With Your NR4 Slip

Managing Ontario property from abroad doesn’t have to be hard. At Blue Anchor, we handle:

- Rent collection

- Tax withholding and CRA payments

- Full property maintenance

- NR4 slip preparation

Contact us today for expert help managing your property and staying tax compliant.

Stay compliant. Stay profitable. Stay stress-free—with Blue Anchor.